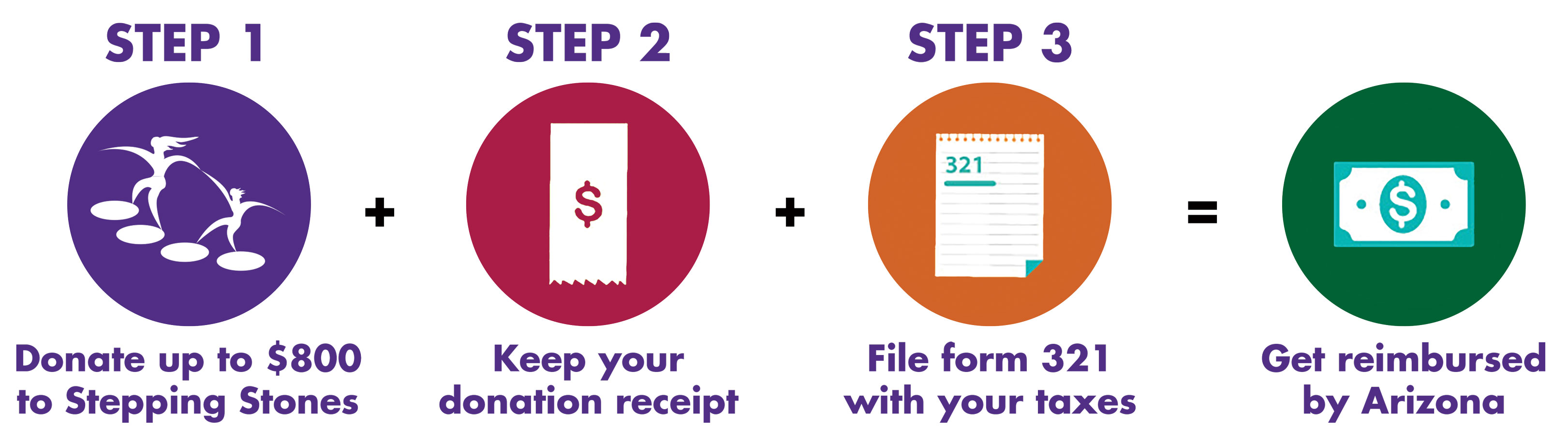

Choose to keep your money local with a 2018 AZ State Charitable Organization Tax Credit donation! This tax credit program allows you to receive a dollar-for-dollar tax credit on your AZ State income tax when you give to Stepping Stones.

For those filing a single tax return, your donation can be up to $400; for those filing jointly, up to $800. This means that money you would otherwise pay toward your AZ tax liability will stay local benefiting families in our community! And, you can give for this credit in additional to the schools tax credit donation!

Call Cori or Alexis at 928.772.4184 for more information or donate online here.

Stepping Stones’ official Qualifying Charitable Tax Credit code from the State of Arizona is: 20034. Please keep this code for use on your tax documents.

Stepping Stones Agencies is a not-for-profit 501(c)3 tax-exempt organization. Check with your tax professional for information regarding donations.

Recent Comments