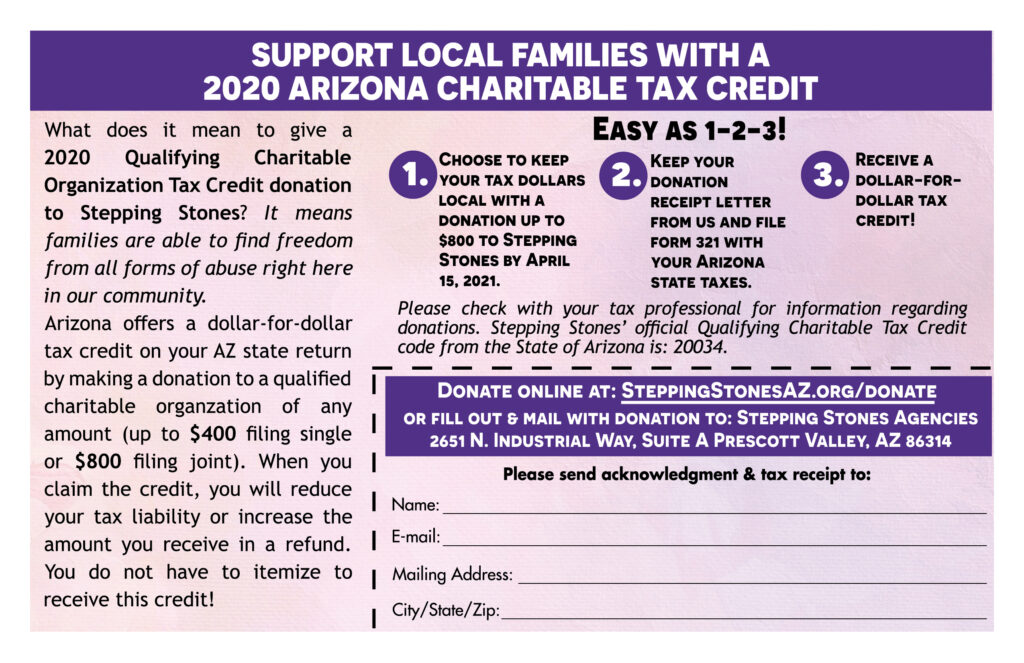

What does it mean to give a 2020 Qualifying Charitable Organization Tax Credit donation to Stepping Stones? It means families are able to find freedom from all forms of abuse right here in our community.

Arizona offers a dollar-for-dollar tax credit on your AZ state return by making a donation to a qualified charitable organization of any amount (up to $400 filing single or $800 filing joint). When you claim the credit, you will reduce your tax liability or increase the amount you receive in a refund. You do not have to itemize to receive this credit!

Ways to give:

- Give online at www.steppingstonesaz.org/donate

- Mail or drop off a check at our Administration Office:

Stepping Stones Agencies

2651 N. Industrial Way, Suite A

Prescott Valley, AZ 86314

***Please check with your tax professional for information regarding donations. Stepping Stones’ official Qualifying Charitable Tax Credit code from the State of Arizona is: 20034.

Recent Comments